8 Steps To Take Before You Prepare Your Taxes

1

Content

These days, many banks, brokerages, and mortgage companies make tax documents available online. So if you’re missing information on investment income or a mortgage interest statement, try logging into your online account to access a copy. If you haven’t filed a tax return and the IRS owes you money, you have a limited number of years to claim your refund. You’re most likely to find it the easiest to use tax software for filing your own taxes.

If you’re comfortable preparing your own taxes, you can useFree File Fillable Forms, regardless of your income, to file your tax returns either by mail or online. Use online account to securely access the latest information available about your federal tax account and see information from your most recently filed tax return. Whether you do your own taxes or hire someone else to handle the task, organizing your records in advance will save you time and, in the case of a paid preparer, money.

How much should tax preparers charge for their services?

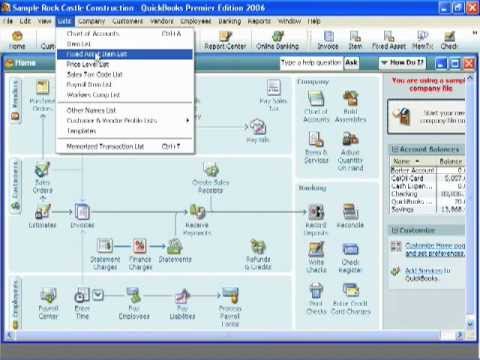

Tax preparers need to efficiently and securely access and manage confidential information for their clients. As a result, most preparers look for software to manage their workflow effectively and efficiently. As is the case with most professions, having access to the right technology will help you work efficiently and contributes to the general success of your new business. Most tax professional software assists with both know-how and the tools to accomplish the work itself. Becoming a tax preparer is a straightforward process involving a few basic requirements.

These https://intuit-payroll.org/ forms come from U.S. employers, stipend/scholarship providers, or schools. The forms, (e.g. W-2, 1042-S, etc) provide information about the amount of money you were paid and what amount was withheld from your payment for tax purposes. Income tax credits can increase your refund or reduce the taxes you owe, but you should only claim credits you can prove you’re eligible for. SeeRecordkeeping for individuals to learn what counts as proof. After filing your tax return you may be asked to provide documentation. The IRS begins accepting and processing federal tax returns on January 23, 2023.

Tax Prep Documents Checklist

During 2022, you should receive a Form 1099-G, Certain Government Payments, showing the amount of unemployment compensation received. Learn more aboutchild and dependent related credits. “I’m glad I read the article. It was informative, and I made the decision to hire my accountant. Thank you.” “Reading this article makes it seem more simple & easy for me to do my taxes manually on my own. Thank you.” If you don’t want to do the return yourself there are many places that will charge a fee to do the process for you. If you are single and have a dependent who lives with you, make sure you check to see if you can qualify as a head of household.

Prep Your Small Business For Tax Day With These 14 Smart Steps – Forbes

Prep Your Small Business For Tax Day With These 14 Smart Steps.

Posted: Wed, 15 Feb 2023 08:00:00 GMT [source]

Use of our products and services are governed by ourTerms of Use andPrivacy Policy. The self-employed health insurance deduction can help offset some of the costs of paying out-of-pocket for health care coverage. Find out who can take the deduction, what it includes, and how to claim it. Even if you haven’t filed or paid taxes in years, it’s possible to get caught up.

Tax Prep Checklist: What to Gather Before Filing

Ultimately, it is your responsibility to meet your tax obligations and do so accurately. Enrolled Agents do not provide legal representation; signed Power of Attorney required.

- These ads are based on your specific account relationships with us.

- In general, experts recommend filing tax returns earlier rather than later.

- Student loan interest.You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Import last year’s return, your W-2, and 1099 forms from payroll and other financial partners.

A Wage and Income Transcript includes all information reported to the IRS on your behalf, such as W-2s and 1099s. You can order a Wage and Income Transcript online via the IRS Get Transcript tool or by mail using Form 4506-T, Request for Transcript of Tax Return. To qualify for the program, your adjusted gross income must have been less than $73,000 in 2022. Mass.gov® is a registered service mark of the Commonwealth of Massachusetts.

However, the extent of what a Steps To Take Before You Prepare Your Taxes preparer can do is based on their credentials and whether they have representation rights. If you can’t file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes.

These ads are based on your specific account relationships with us. Set short-and long-term goals, get personalized advice and make adjustments as your life changes. Many or all of the products featured here are from our partners who compensate us.

Does Your Business Need Tax Preparation Services?

Getting caught up on your tax filing obligations offers several advantages. That might sound convenient, but it’s rarely beneficial. Whenever possible, you’re better off filing back taxes on your own .

Extension to File Your Tax Return

If you can’t file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service (IRS). This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 18, 2023.